Double-entry is more complex, but also more robust, and more suitable for established businesses that are past the hobby stage. When you’re stuck in the minutiae of reconciling your transactions, this won’t feel like “seven easy steps”. If your bookkeeper bills your customers or pays your vendors and employees, make sure you have proper checks and balances in place to mitigate the possibility of fraud.

Choose an entry system

Learn about https://www.bookstime.com/, typical responsibilities, how to become a bookkeeper, and remote bookkeeping opportunities with Intuit’s QuickBooks Live in the U.S. Accrual basis accounting records those invoices and bills even if the funds haven’t been exchanged. Generally, accrual basis is the recommended accounting method and more aligned with generally accepted accounting principles. Here’s a crash course on small-business bookkeeping and how to get started. Most small businesses will either do their books themselves or outsource the work to a professional. But even if an expense is ordinary and necessary, you may still not be able to deduct all of it on your taxes.

Explore what you can do with QuickBooks

Accountants rely on bookkeeping records to analyze and advise on the financial activity, health, and growth potential of a business. The American Institute of Professional Bookkeepers offers certification for experienced bookkeepers. You will learn how to record costs, value inventory, calculate depreciation, analyze financial statements, and use software programs. The courses cover bookkeeping, Microsoft Excel, business math, and payroll administration. Your job as a bookkeeper entails systematically keeping track of an organization’s financial transactions.

Bookkeeping Options for Small Business Owners

Bookkeepers are not required to have certifications or specific education unless required by a specific employer. However, completing a bookkeeping certification program can teach you basic accounting and how to perform bookkeeping tasks and has the potential to set you apart from other bookkeepers. Some accounting software products automate bookkeeping tasks, like transaction categorization, but it’s still important to understand what’s happening behind the scenes.

If you’re a detail-oriented individual who enjoys working with numbers, then you might consider a career as a bookkeeper. Cassie is a deputy editor collaborating with teams around the world while living in the beautiful hills of Kentucky. Prior to joining the team at Forbes Advisor, Cassie was a content operations manager and copywriting manager.

The difference between bookkeeping and accounting

Having the ability to prepare an accurate financial picture of an enterprise and keep records organized is essential for being a bookkeeper. As a bookkeeper, you will need to learn how to create balance sheets, invoices, cash flow statements, income statements, accounts receivable reports, and more. Although software and calculators do most of the math, basic skills such as addition, subtraction, multiplication, and division are essential to helping you catch errors quickly.

- If your business is a side project with a limited budget, you can probably get by going the DIY route.

- However, if you don’t have a lot of bookkeeping experience (or don’t have time to learn), they could stress you out more than they help you.

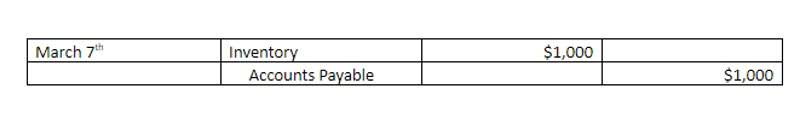

- Businesses that have more complex financial transactions usually choose to use the double-entry accounting process.

- Though having a two-year or four-year degree isn’t always required to be hired as a bookkeeper, some companies may prefer candidates who do.

Additionally, the aged accounts receivables and aged accounts payables reports are helpful in knowing which customers have not paid and which vendors are yet to be paid. These reports will help you gain greater insights into the financial health of your small business. Accountants, on the other hand, use the information provided by bookkeepers to summarize a business’s financial position and render financial advice to the business owner. Many accountants also prepare tax returns, independent audits and certified financial statements for lenders, potential buyers and investors. Typically, single entry bookkeeping is suitable for keeping track of cash, taxable income, and tax deductible expenses.

Ask for testimonials from people who have utilized your services in the past and spread the word about your offerings through a website or social media. It is not an unusual career move for a bookkeeper to gain experience at a job, study, get certified, and work as an accountant. There are various career paths for accountants (and some for bookkeepers), from working as a forensic accountant to becoming a financial auditor or an enrolled agent. The Certified Bookkeeper (CB) program from the AIPB requires you to be a working bookkeeper or have at least one year of accounting education. The program includes self-teaching workbooks that prepare you to pass the CB exam. Read more below to learn about bookkeeping, typical responsibilities, how to become a bookkeeper, and remote bookkeeping opportunities with Intuit working onQuickBooks Live in the U.S. 50 states.

- The debited account is the one that receives or loses value, and the credited account is the one that gives or gains value.

- The education required to be competitive in the field is greater, but the payoff down the road can be considerably higher.

- Bookkeeping is largely concerned with recordkeeping and data management.

- Every transaction you make needs to be categorized and entered into your books.

- Customers schedule an appointment to have a bookkeeper review their transactions, and multiple schedules are available to choose from.

- Even with these tools, you may not have the expertise you need to handle the responsibilities of a bookkeeper.

- Mixing together personal and business expenses in the same account can also result in unnecessary stress when you need to file taxes or do your bookkeeping.

- With this method, bookkeepers record transactions under expense or income.

- Without bookkeepers, companies would not be aware of their current financial position, as well as the transactions that occur within the company.

- If your bookkeeper bills your customers or pays your vendors and employees, make sure you have proper checks and balances in place to mitigate the possibility of fraud.

The IRS also has pretty stringent recordkeeping requirements for any deductions you claim, so having your books in order can remove a huge layer of stress if you ever get audited. The more information (and supporting documents) you can give your CPA at tax time, the more deductions you’ll be able to legitimately claim, and the bigger your tax return will be. You can’t run a healthy, successful business without having your books in order. It’s like driving a car without a fuel gauge or a map—sooner or later you’re going to get lost or run out of gas.