Plus, they specifically work with private practice owners because they believe in the importance of mental health clinicians having sound businesses. bookkeeping for therapists Because I appreciate their service so much, I’m an affiliate for them. I wouldn’t be an affiliate for anything I didn’t absolutely love and use.

Bookkeeping benefits for private practice owners

If you’d like to avoid the extra hassle of doing research, you could always open a business checking account with the same bank that you do your personal banking with. The biggest factor to be aware of is that some banks charge a monthly fee for business accounts, while others require a minimum balance in your checking account in order to avoid any fees. Be sure to educate yourself on those details before diving in. Whether you are a mental health professional, allied health practitioner, speech therapist, or physical therapist, your private practice is your passion. We’ve helped many professionals in private practice to not only clean up their books but to make sense of the books they have so their private practice can thrive. List your practice in relevant therapy directories and actively engage on social media platforms to connect with potential clients.

We’re loved by thousands of therapists.

- Even with everything I just said, I think the reason why a lot of therapists opt to do their own accounting and taxes is because they’re not sure what other options are available.

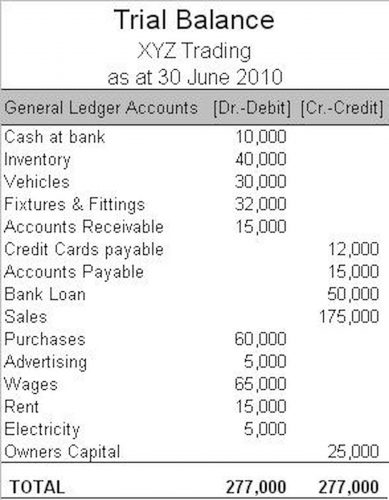

- Likewise, you could see an expense of $2,000 show up in your general ledger, and have no idea whether it was the first month’s rent in your new office, or the money you spent on new office furniture.

- Today is the day to build the organization of your dreams!

- I’ve crossed my fingers and toes for you that you don’t ever get audited by the IRS.

(No you cannot just go to dinner with your spouse and write it off as a business expense!) Again, check with an accountant on this. First of all, I would HIGHLY recommend that you talk to an accountant or other financial professional to learn what is required as a small business owner in your state. State tax laws can vary and how you need to track and keep records may differ as well.

Financial support at every step in your journey as a therapist

Expenses are anything you need to pay out in order to run your practice. Expenses are somewhat tied to liabilities, but not always. For example, office supplies you buy when you need them are an expense but not a liability, unless you used a credit card to buy them. In the previous blog post I did, I talked about the importance of knowing how to make the transition from being employed to being self-employed. We talked about some of the different ways to structure the business in terms of it being a sole proprietorship vs. a LLC or other business entity. This is an important concept when it comes to the financial side of private practice.

To A Growing Business

- Let’s talk about how optimizing your financial processes can take it to the next level.

- This post and accompanying podcast are to be used for informational purposes only and does not constitute legal, business, or tax advice.

- If you are using an application like Freshbooks or Quickbooks, you can get a balance sheet report.

- Another example of spending money to make more money is when you need to outsource things to become more productive.

- Maintaining a clear communication channel with clients about treatment plans and progress is also important, which fosters trust and satisfaction.

- An accounting application that comes highly recommended is Freshbooks.

List all of your business bank accounts, both checking and savings. Here are seven steps you can take to create your own custom chart of accounts for your therapy practice. Looking at your balance sheet, income statement, and statement of cash flows each month keeps you aware of your current revenues, expenses, receivables, and payables. It also https://www.bookstime.com/ helps you spot potential problems before they become serious ones and gauge your progress toward your financial goals. When pressed for time, it’s tempting to put bookkeeping on the back burner. Fortunately, there are some best practices you can implement to make the record-keeping process more manageable while saving you time, money, and sanity.

Setting Up B&O Accounts

This includes computers, an EHR (Electronic Health Records) system that can help manage client data securely, and reliable teletherapy tools if offering online sessions. Quality soundproofing helps maintain privacy during every session, reinforcing your commitment to confidentiality and quality care. As a small business if you are making under 6 figures and have everything organized- it shouldn’t cost more than $70 a month for someone to do your bookkeeping. They can provide you with all of your reports for tax time or to take to your appointment with the CPA during tax time.

- Another report that is a good to look at often is the profit and loss statement.

- And often the DIY path can often create more problems then problems solved.

- If you understand how your cash flows into and out of your business, you can properly pay your staff and other expenses and ensure you still bring home a profit.

- Read high quality, fact-checked articles on private practice finances.

- Bain is one of the largest and most prominent PE firms and was founded in 1984 by Mitt Romney.

- Sikich dates back to 1982 and has traditionally been very active in doing mergers and acquisitions.

New Requirement for Small Businesses: the Beneficial Ownership Information Report

Your business address gets listed in invoices instead of your personal address

Cut unnecessary spending