BTCUSD course forecast from May 30 to June 5

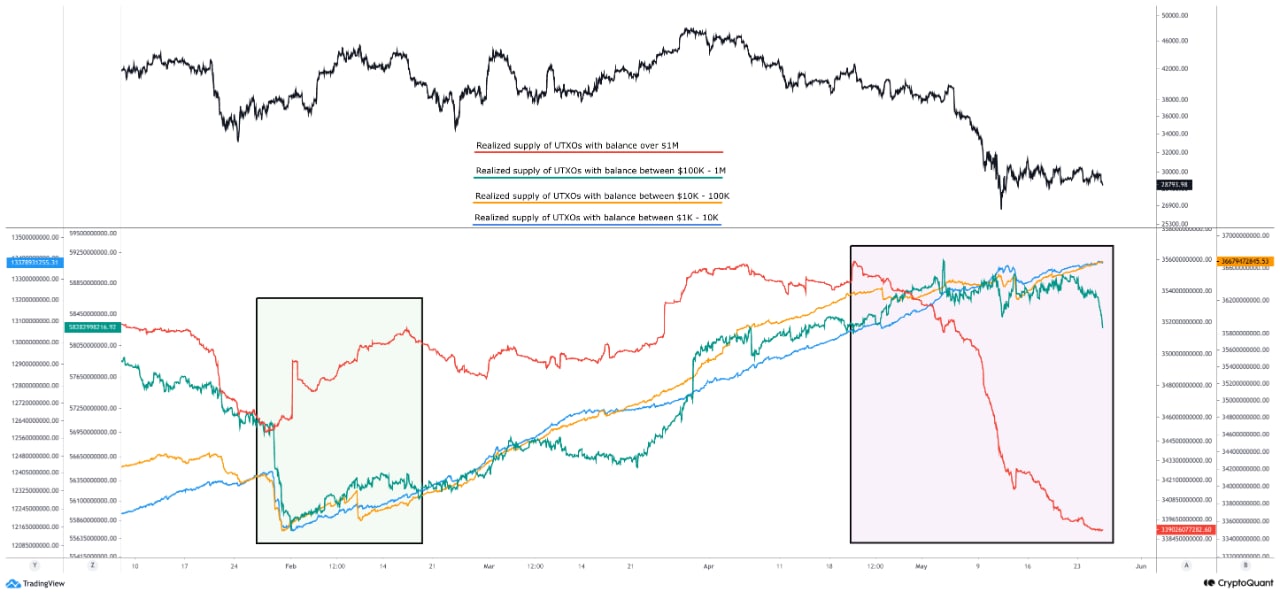

Whales owning BTC in the amount of more than $ 1 million sold their stocks of bitcoin since May 5, which led to the fact that BTC prices from $ 40,000 decreased to $ 30,000. The good news is that last week, apparently, the sale of assets began to decline. This means that sales pressure from these whales end. On the other hand, small whales, presumably retail and individual investors, were the main buyers during consolidation last week. However, until we see that large whales began to buy BTC again, there is a high probability of turning retail merchants into sellers. This can provoke a downward movement, which will most likely be fast and sharp.

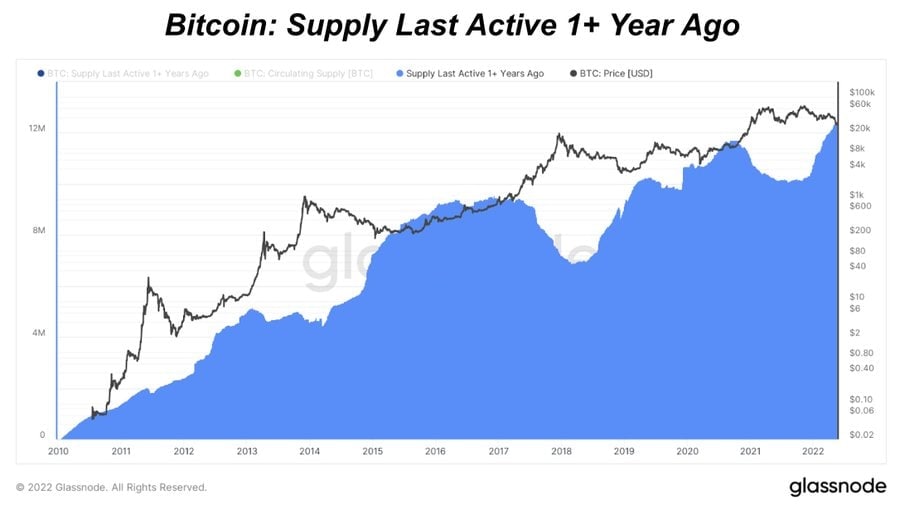

However, Bitcoin’s proposal, the last time activated more than a year ago, shows that long -term holders do not show signs of surrender, since the number of non -interpreted BTC continues to grow, even when the price has retreated.

At the moment, more than 12 million BTCs have not been moved over the past year. If this number continues to grow, any BTC price rollback may not be very significant. On the other hand, traders should pay attention when the number of such “old coins” begins to decline, as this means that long -term holders sell their coins.

JPMorgan report can give investors the belief that BTC can be kept longer. Although JPMorgan is known for the fact that for many years he criticized Bitcoin, in his last report the bank seemed to be supported by his support, calling the BTC a scarce asset with significant growth potential, which could fulfill the dreams of many of his supporters, becoming an “alternative” currency similar gold.

http://coin-graph.website/?p=864

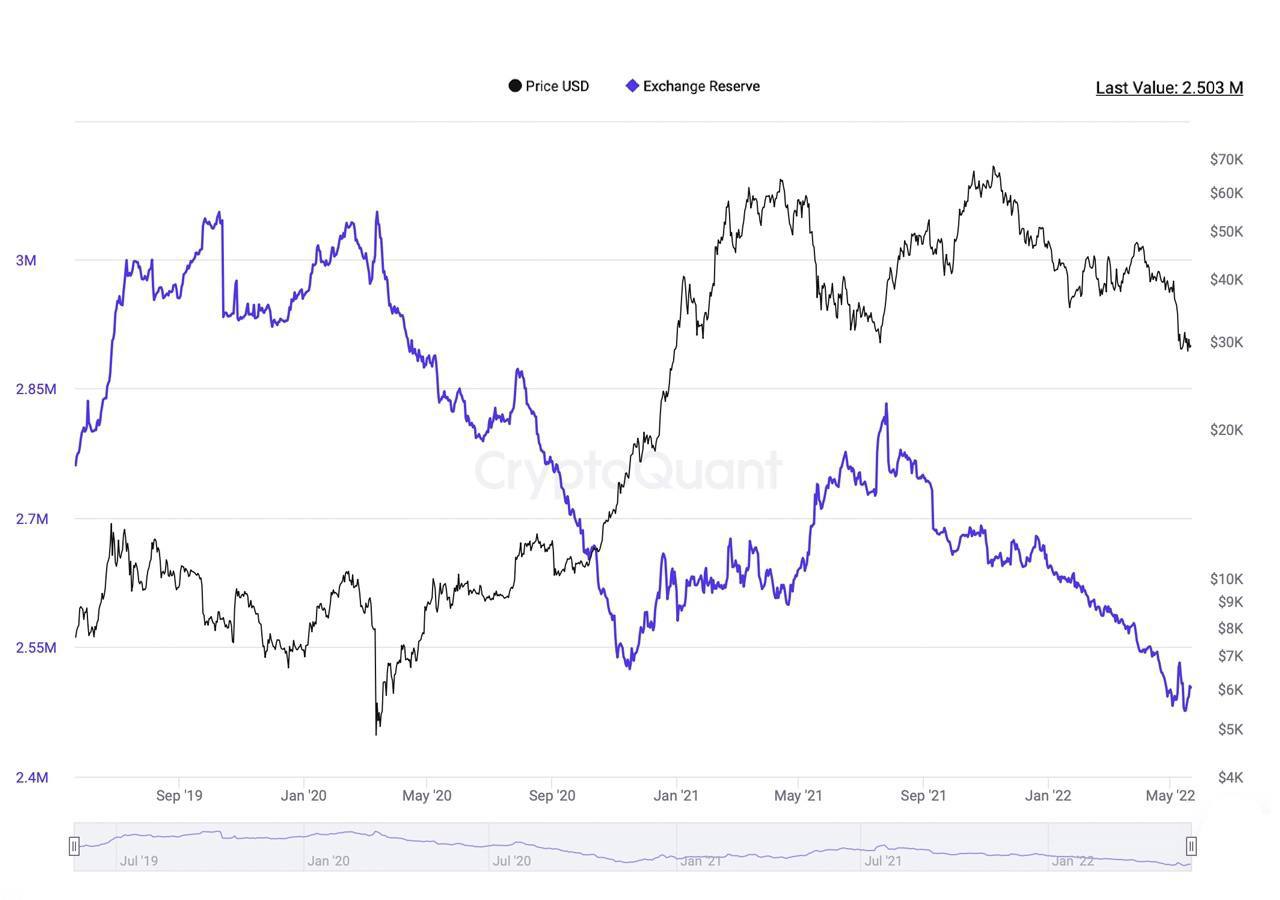

Although the BTC at the level of $ 28,000 can be a profitable deal in the future, its closest prospects remain shaky if you look at the latest data on the exchange reserve.

After a consistent fall in the previous week, which indicates purchasing activity, the BTC exchange reserve at the end of the week began to grow a little again. This means that investors transferred their assets to exchanges to prepare for sale.

This material is not a financial advice and brings only familiarization information.

Revenuebot has https://gagarin.news/ru/news/the-bank-of-canada-and-the-massachusetts-institute-of-technology-are-investigating-cbdc/ a Telegram chat for users and an official Telegram channel where the service news is published, as well as relevant information from the crypto industry. You can familiarize yourself with the capabilities of the service on the official website Revenuebot .